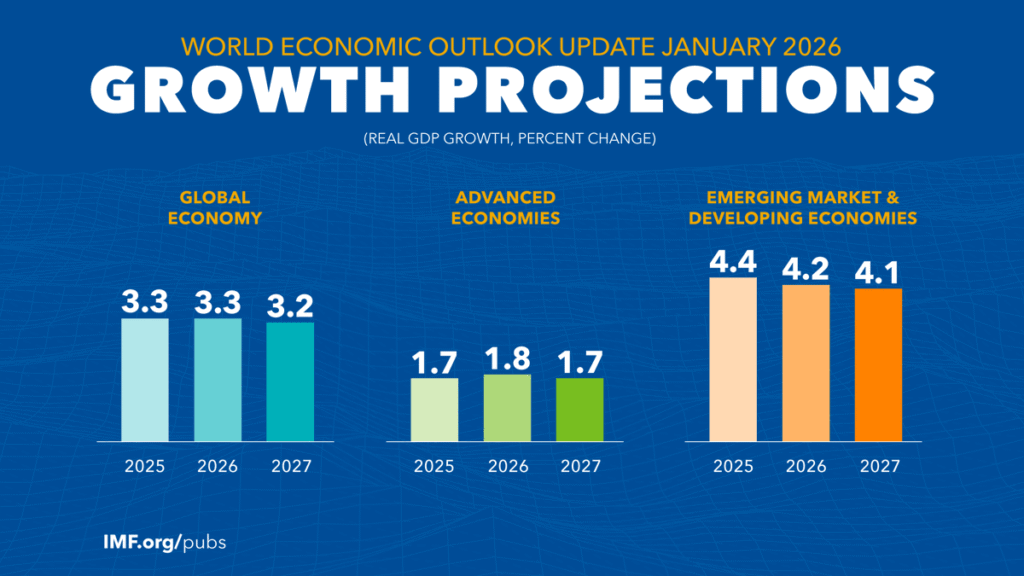

JOHANNESBURG, Jan 20 – The International Monetary Fund expects emerging market and developing economies to maintain steady growth over the next two years, outperforming advanced economies despite ongoing global uncertainties.

In its January 2026 World Economic Outlook Update, the IMF projected EMDE growth of 4.2% in 2026 and 4.1% in 2027. Both forecasts were revised upward from October estimates, reflecting stronger export performance in Asia, policy stimulus in key economies, and easing drag from trade restrictions.

Advanced economies are expected to grow more slowly, highlighting a widening divergence driven by demographic pressures, tighter fiscal space, and lower productivity gains in developed markets.

Emerging and Developing Asia remains the main growth engine, with output projected to expand by 5.0% in 2026 and 4.8% in 2027. China’s growth outlook was revised up to 4.5% following additional stimulus measures and a temporary easing in US-China trade tensions, while India is expected to grow by 6.4%, supported by domestic demand and public investment.

Sub-Saharan Africa is projected to accelerate to 4.6% growth in both 2026 and 2027, up from earlier forecasts. The improvement reflects stabilization in major economies such as Nigeria, forecast to grow by 4.4%, and South Africa, where growth is expected to reach 1.4% as energy constraints ease and reforms gain traction.

Growth in the Middle East and Central Asia is projected to rise to between 3.9% and 4.0%, supported by higher oil output and structural reforms. Saudi Arabia’s economy is forecast to expand by 4.5% as investment activity remains strong.

Elsewhere, Latin America and the Caribbean is expected to slow to 2.2% in 2026 before rebounding to 2.7% in 2027 as economies converge toward potential growth. Brazil and Mexico are forecast to grow by 1.6% and 1.5% respectively. Emerging and developing Europe is projected to recover modestly after a 2025 slowdown, with growth of 2.3% to 2.4%, while Russia’s economy is expected to expand by just 0.8%.

Low income developing countries are forecast to grow by 5.1%, underlining widening performance gaps within the EMDE group.

Inflation across emerging markets is expected to continue easing, falling to 4.8% in 2026 and 4.3% in 2027, faster than in advanced economies. The IMF noted that price pressures remain uneven, with China emerging from low inflation and India moving closer to its policy targets, while tariff pass-through in the United States and softer commodity prices shape global trends.

The Fund warned that downside risks remain dominant. These include renewed trade tensions, geopolitical shocks that disrupt supply chains, and the risk that artificial intelligence related investment fails to deliver expected productivity gains. Fiscal constraints and policy uncertainty also continue to weigh on many emerging economies.

At the same time, the IMF said faster adoption of AI technologies, easing trade frictions, and sustained reform momentum could lift medium term growth. It urged emerging economies to rebuild fiscal buffers, accelerate structural reforms, and invest in skills and digital readiness to better position themselves for the next phase of global growth.