LAGOS, Feb 16 – Africa’s long term economic transformation may ultimately depend not on theoretical access to capital, but on its ability to mobilise sufficient financing to power its economies.

Nearly 600 million people across Africa remain without access to electricity, representing the largest energy access deficit globally. Electrification gains have slowed in recent years, with fewer than 19 million people gaining access annually in 2023 and 2024, down from 23 million in 2019, reflecting the lingering effects of the pandemic and tighter global financial conditions.

According to the International Energy Agency, Africa’s electricity challenge is fundamentally a financing problem, driven by limited private sector participation and heavy reliance on public and concessional funding.

Public Capital Dominates as Private Investment Remains Limited

Total financing commitments for electricity access expansion in sub-Saharan Africa reached less than $2.5 billion in 2023, far below what is required to close the continent’s energy gap.

Private investment contributed just $640 million, accounting for less than 30 percent of total financing, while international public finance provided approximately $1.8 billion, underscoring the central role of development finance institutions and multilateral lenders.

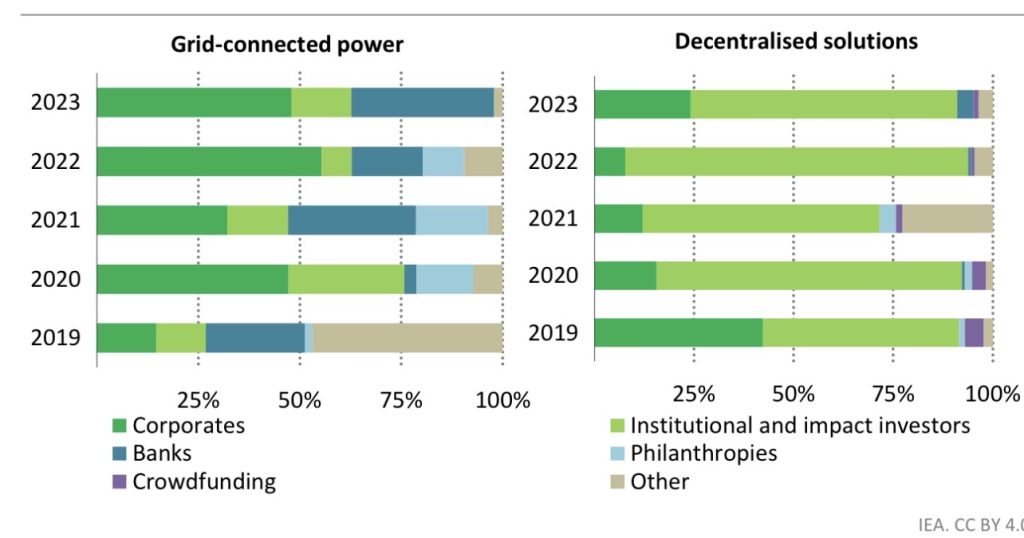

decentralised solution access projects, 2019-2023

Concessional funding represents roughly 55 percent of public electricity financing, equivalent to about $1 billion annually. However, the growing shift from grants to concessional loans presents new risks for lower income countries already burdened by rising debt servicing obligations.

Although private investment has expanded modestly at an annual rate of about 16 percent between 2019 and 2023, capital remains concentrated in larger and more established companies, leaving smaller African developers and early stage projects structurally underserved.

Equity financing remains particularly scarce. Total equity investment reached just $580 million in 2023, far below levels needed to support scalable project pipelines.

Government Spending Is Rising but Fiscal Limits Persist

African governments continue to play a central role in financing electrification. Across 23 sub-Saharan African countries, electricity access accounted for approximately 35 percent of national energy budgets in 2025.

Government funding increased significantly, rising from $1.1 billion in 2024 to $1.9 billion in 2025, reflecting growing political commitment to expanding electricity access.

However, fiscal pressures remain severe. Many state owned utilities are heavily indebted and financially constrained, limiting their ability to independently fund large scale electrification programs. Governments are often required to recapitalise utilities and subsidise tariffs, placing additional strain on national budgets.

This public sector driven model is unlikely to achieve universal electricity access without substantially greater private sector participation.

2019-2023

Africa Needs $150 Billion to Achieve Universal Electricity Access

The International Energy Agency estimates that Africa will require approximately $150 billion in total investment by 2035 to achieve universal electricity access, equivalent to about $15 billion annually, roughly six times current investment levels.

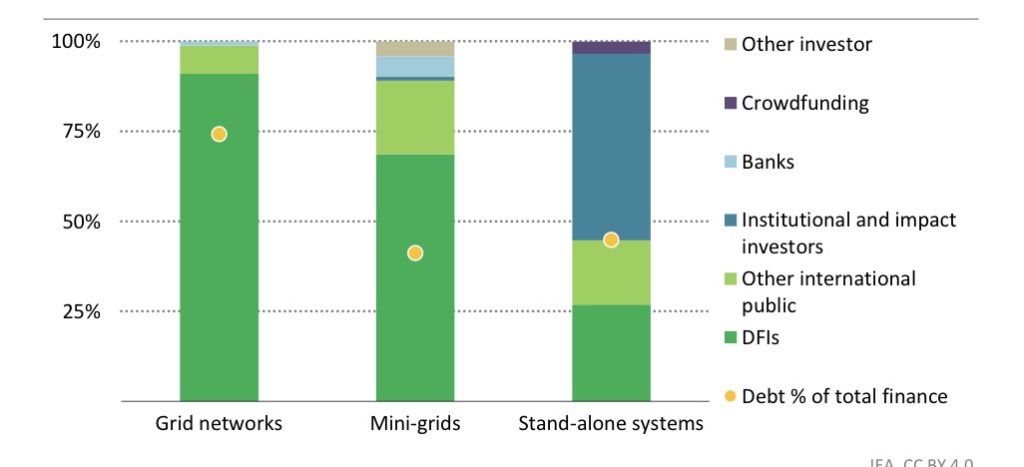

This investment will be distributed across multiple infrastructure channels:

- $7 billion annually for grid expansion

- $5 billion annually for mini grid deployment

- $3 billion annually for stand alone solar systems

Private investment is expected to play a much larger role going forward, potentially accounting for more than 45 percent of total financing, supported by regulatory reforms, blended finance structures, and risk mitigation mechanisms designed to attract institutional investors.

Concessional Finance Will Remain Essential to Unlock Private Capital

Despite expected growth in private sector participation, concessional funding will remain critical to attracting private investment.

Concessional capital is projected to contribute about $6.2 billion annually through 2035, helping absorb risk, improve project viability, and encourage institutional participation.

Grant financing alone is expected to total approximately $3 billion annually, particularly in higher risk and underserved markets where commercial investment remains limited.

Patient equity capital will also need to increase significantly, reaching approximately $5 billion annually, while debt financing is expected to expand to roughly $7 billion per year, supported by greater participation from commercial banks and institutional investors.

This shift reflects the gradual emergence of electricity access as a viable investment class rather than solely a development priority.

Affordability and Financing Costs Remain Major Barriers

Even where electricity infrastructure exists, affordability remains a critical challenge. Approximately 220 million Africans cannot afford basic electricity services, highlighting the need for targeted subsidies and concessional financing.

Electricity projects across Africa face financing costs up to four times higher than in developed markets, driven by currency volatility, regulatory risk, and smaller project scale.

Reducing financing costs could lower electricity delivery costs by up to 25 percent, significantly improving affordability and investment viability.

Electricity Access Is Becoming Africa’s Most Important Investment Frontier

Electricity access is foundational to industrialisation, manufacturing competitiveness, digital infrastructure, and overall economic productivity.

Without reliable and affordable electricity, Africa’s broader economic transformation will remain structurally constrained.

Closing the electricity financing gap will require large scale mobilisation of private capital, supported by concessional funding, regulatory reform, and innovative financial instruments.

Electricity access is no longer solely a development objective. It is rapidly emerging as one of the most important capital allocation challenges shaping Africa’s long term economic future.